Product contribution margin

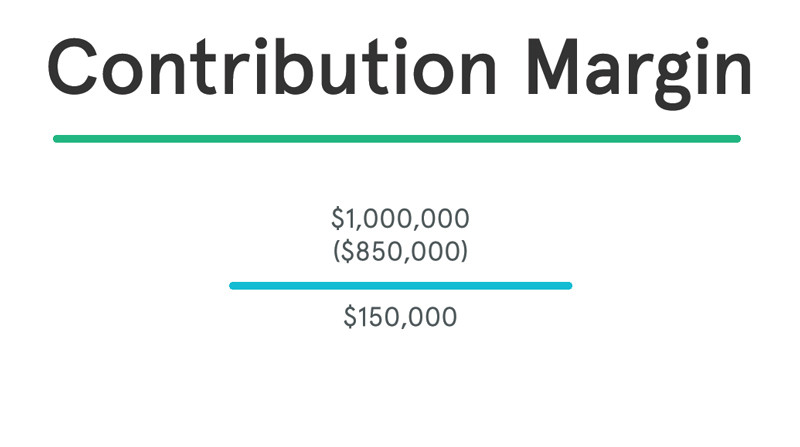

Contribution margin is a products price minus all associated variable costs resulting in the incremental profit earned for each unit sold. Contribution margin CM or dollar contribution per unit is the selling price per unit minus the variable cost per unit.

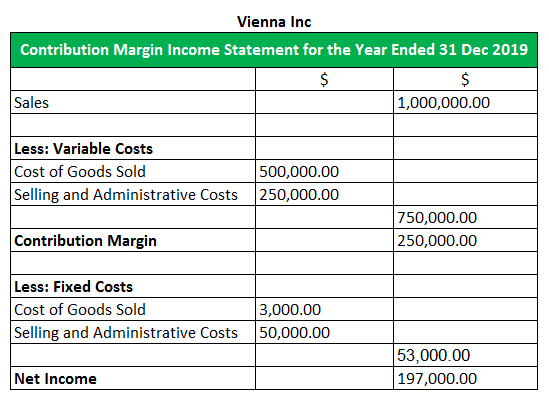

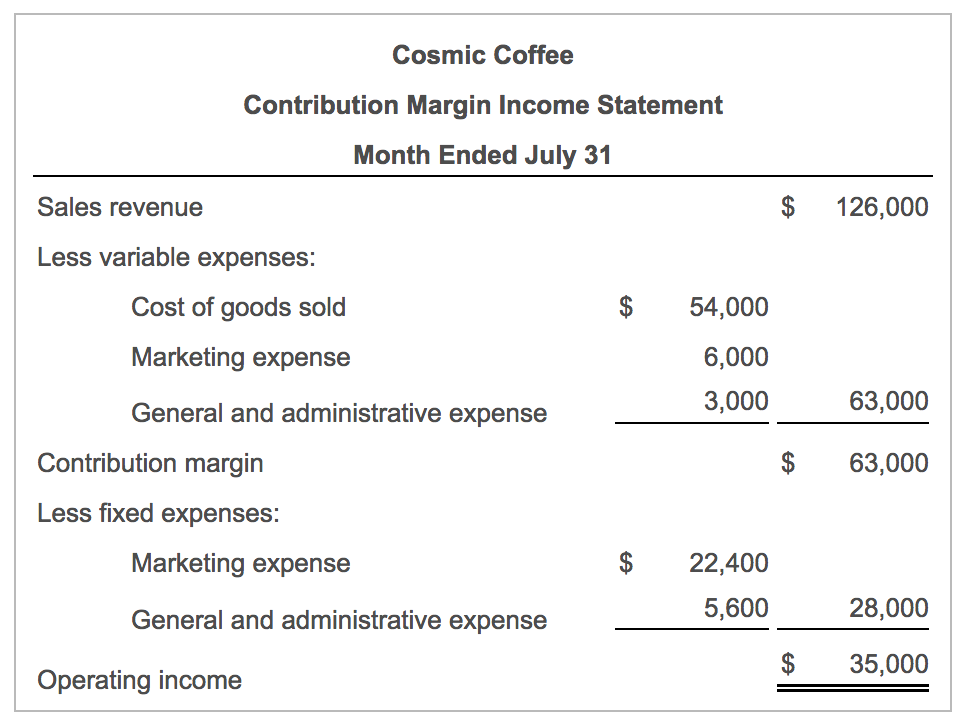

Contribution Margin Income Statement Explanation Examples Format

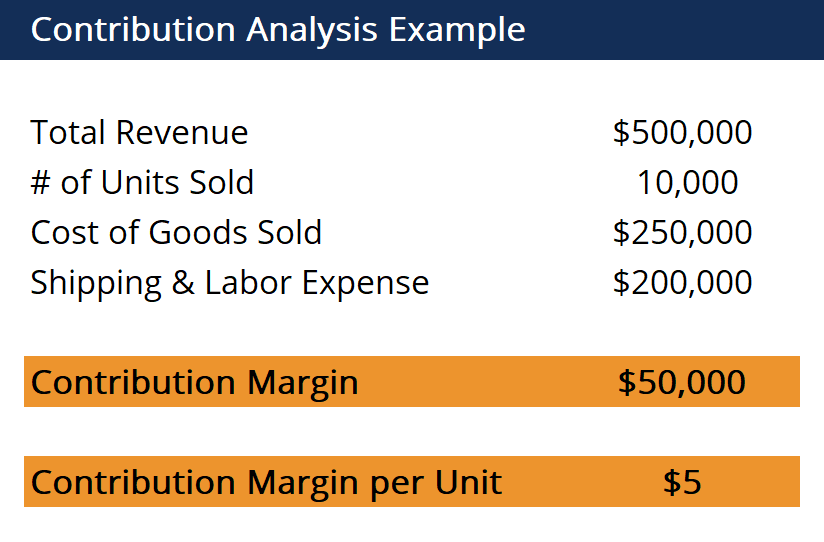

Heres an example of how to solve for contribution margin.

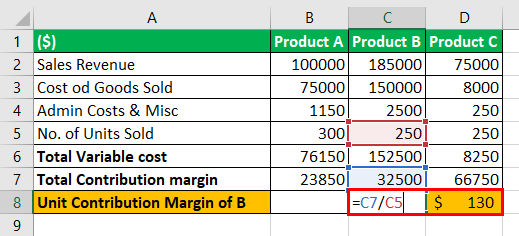

. Product B is contributing more for covering fixed. Product Contribution margin ratio is commonly expressed as a percentage of sales prices. We can calculate the contribution margin of the pen by using the formula given below.

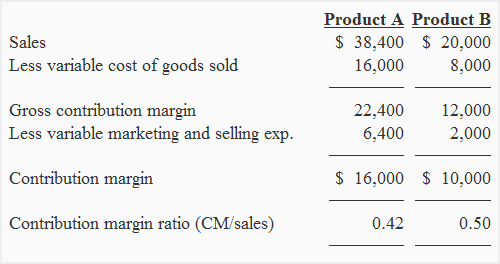

However a low contribution margin product may be deemed as a sufficient outcome if it uses very little resources of the company to produce and is a high volume sale product. Product As contribution margin ratio is 042 or 42 where as product Bs contribution margin ratio is 05 or 50. Product Contribution Margin means for any fiscal year the ratio derived by dividing i the Total Product Contribution by ii the Company s net sales for such fiscal year.

Contribution Margin Net Sales Total Variable Expenses Contribution Margin 10 6. Contribution margin is the revenue that is generated beyond what is necessary to cover the variable costs of production such as materials and non-salaried labor costs. Evaluating the contribution margin ratio.

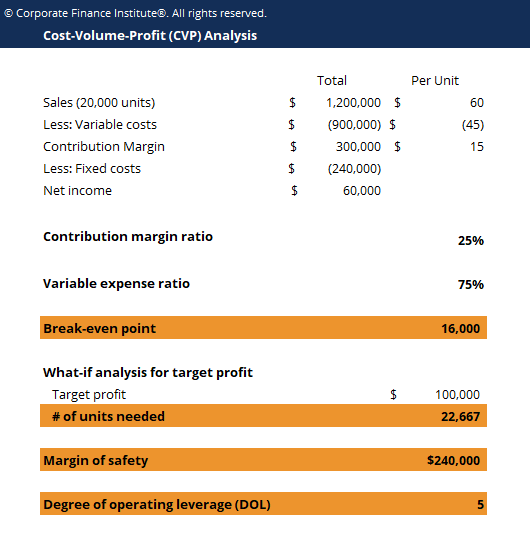

The contribution margin ratio can be used as a measure of a companys profitability as well as a measure of how profitable a particular product line is. The salesman who completed the deal will receive a 2000 commission so the. Thus Contribution Margin Sales Revenue Variable Cost Or Contribution Margin Fixed Cost Net Income Contribution margin is used to plan the overall cost and selling price for your.

If a product sells for 100 and its variable cost is 35 then the products contribution margin is 65. That means the company. Products Contribution Margin Ratio.

In accounting contribution margin is the difference between the sales revenue and the variable costs of a product. It represents how much money can be generated by each unit. Contribution represents the portion of sales revenue that is not.

Contribution Margin Sales Income - Total Variable Costs For variable costs the company pays 4 to manufacture each unit and 2 labor per unit. The transaction is for a product sale where the direct cost of the product is 50000. What is the Contribution Margin.

It is the difference between a. The contribution margin is calculated by subtracting variable costs from revenue then dividing the result by revenue or revenue - variable costs revenue.

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

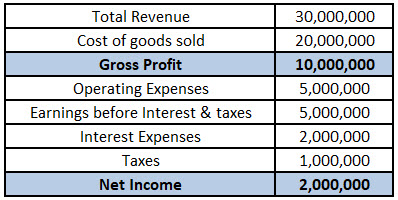

How Do Gross Profit And Gross Margin Differ

Unit Contribution Margin Meaning Formula How To Calculate

Contribution Margin Vs Gross Margin Top 6 Differences With Infographics

Contribution Margin Formula And Ratio Calculator Excel Template

What Is Contribution Margin

Performing Contribution Margin Analysis Magnimetrics

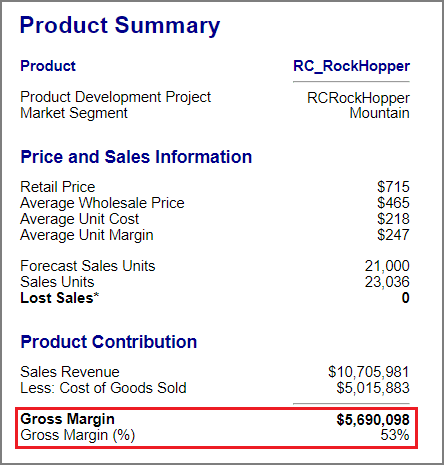

How Do I Calculate Gross Margin Smartsims Support Center

Contribution Margin Ratio Formula Per Unit Example Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Solved Linda Fashions Product Line Contribution Margin Chegg Com

How Does Gross Margin And Net Margin Differ

Contribution Analysis Formula Example How To Calculate

Cvp Analysis Guide How To Perform Cost Volume Profit Analysis

What Is The Gross Profit Margin Bdc Ca

Contribution Margin Explained In 200 Words How To Calculate It Cristian A De Nardo

Contribution Margin Ratio Revenue After Variable Costs

Contribution Margin Ratio Explanation Formula Example Accounting For Management